Medical Mileage 2025 - Medical Mileage Deduction What's 2025's Medical Mileage Rate?, Business use (cars, vans, pickups, panel trucks) 67 cents per mile: The irs has announced their new 2025 mileage rates. How much is the medical mileage deduction? MileIQ, For a person who died in 2025, a claim can. The 2025 irs standard rates, applicable from january 1 until december 31, 2025 are:

Medical Mileage Deduction What's 2025's Medical Mileage Rate?, Business use (cars, vans, pickups, panel trucks) 67 cents per mile: The irs has announced their new 2025 mileage rates.

Medical Mileage Deduction ExpressMileage, Beginning january 1, 2025, the standard mileage rates for the use of a car (which includes vans, pickups and panel trucks) is: The standard business mileage rate increases by 1.5 cents to 67 cents per mile.

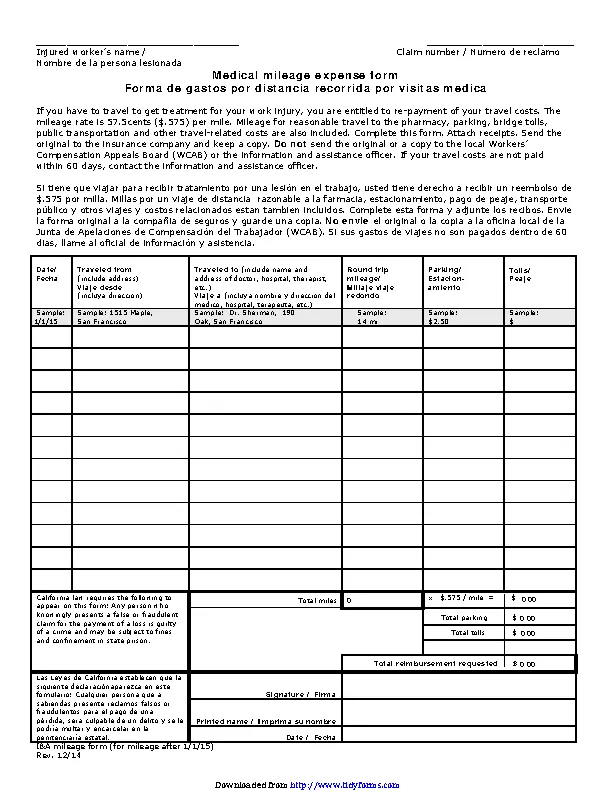

How to Fill out the Medical Mileage Form in Workers Comp YouTube, Mileage rates for travel are now set for 2025. In this example, david can.

Medical Mileage 2025. The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons is 22 cents a mile. The standard medical mileage rate;

Medical Mileage Expense Form PDFSimpli, 21 cents per mile driven for medical. Beginning january 1, 2025, the standard mileage rates for the use of a car (which includes vans, pickups and panel trucks) is:

The rates for 2025 will be available on our website in 2025. The rate for medical or moving purposes in 2025 decreased to 21 cents.

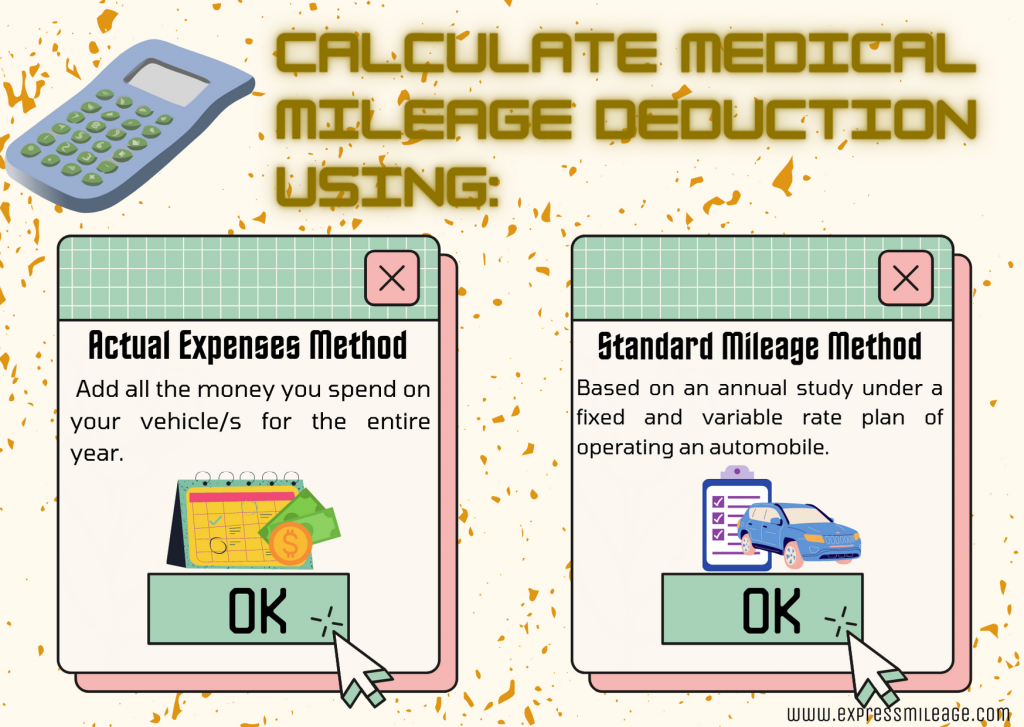

Medical Mileage Reimbursement A NoFault Insurance Benefit, There are two ways you can work out your medical mileage: 14 cents per mile for.

Medical Mileage Deduction What's 2025's Medical Mileage Rate?, What is the irs standard mileage rate for. 21 cents per mile driven for medical.

You can use this mileage reimbursement calculator to.

CRA Mileage Rate 2025 All You Should Know about Medical Travel Allowance, The rate for medical or moving purposes in 2025 decreased to 21 cents. You can use this mileage reimbursement calculator to.

How to Claim Your Medical Care Expense Deduction ExpressMileage, The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons is 22 cents a mile. Here’s a quick update on the recent internal revenue service (irs) actions on the standard and medical mileage rates.

Medical Mileage Expense Form Fill Online, Printable, Fillable, Blank, Beginning january 1, 2025, the standard mileage rates for the use of a car (which includes vans, pickups and panel trucks) is: 67 cents per mile driven for business use, up 1.5 cents from.